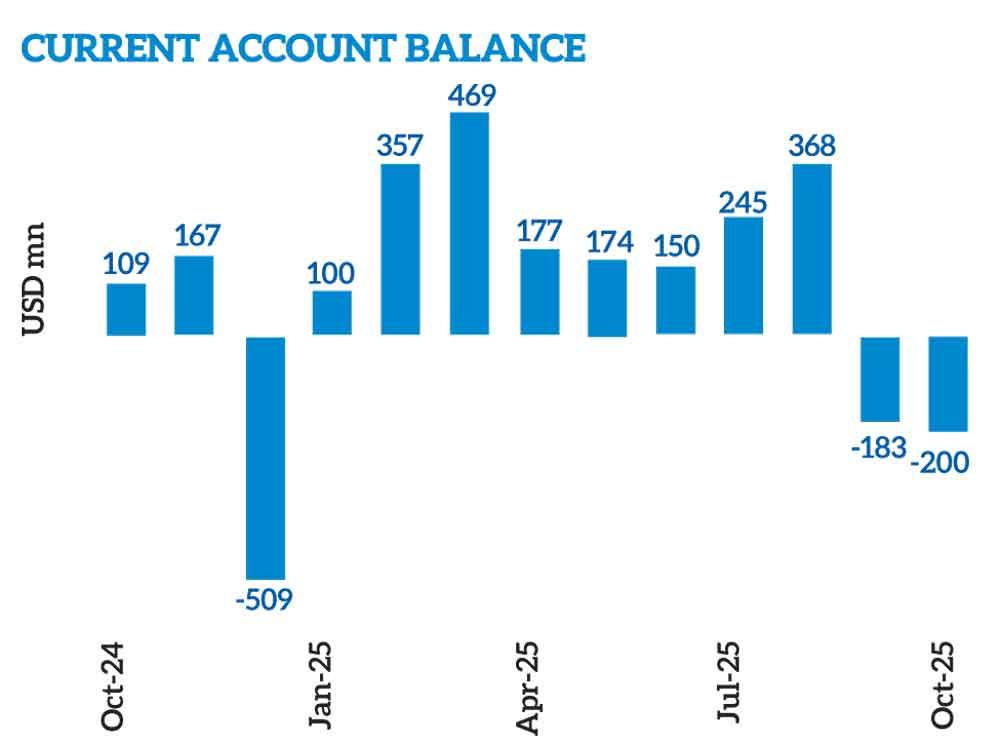

- Current account balance turns negative for second consecutive month but full year intact

- Trade deficit rose to US$ 1,007.4 mn in October, the highest level for a month

Sri Lanka imported goods worth of US$ 2,156.8 million in October with vehicle imports for the month coming in at US$ 261.0 million. This is as the Central Bank put brakes on the breakneck speed at which the foreign exchange was draining to bring down vehicles by cutting the financing share from the banks and finance companies.

The highest imports were also as a result of the ongoing expansion in the economy which is expected to be around at the same levels of 2024 when the Gross Domestic Product grew by 5 percent.

Meanwhile, for fuel Sri Lanka spent US$ 357.8 million, up 6.1 percent from a year ago of which US$ 282.7 million was on refined petroleum exports.

For the first ten months, Sri Lanka spent US$ 1,465 million on vehicles – both personal and commercial – while on fuel it spent US$ 3,319.1 million, down 8.1 percent from the same period last year.

The total merchandise imports for the ten months came in at US$ 17.55 billion, up 13.8 percent causing the trade deficit to widen.

The trade deficit rose to US$ 1,007.4 million in October, the highest level for a month from US$ 544.4 million in the same month last year.

This is while the merchandise exports was little changed at US$ 1,149.4 million for October with the ten months exports at US$ 11,364.5 million, up 6.4 percent.

As a result, the ten months trade deficit came in at US$ 6.2 billion, up sharply from US$ 4.7 billion from the same period last year.

With net services inflows, the export earnings reached US$ 14.45 billion, the highest ever 10 months tally in Sri Lanka.

The current account of the balance of payment fell into negative US$ 199.5 million in October 2025, the second consecutive month with a negative balance, due to the higher imports.

However, in the first ten months, the current account remained a surplus of US$ 1,657.4 million, up 7.1 percent from a year ago.

The Central Bank expects to close the year with a surplus due to higher inflows expected towards the latter part of the year.

Source: Daily Mirror